Turbos – High APY on SUI

What is Turbos Finance?

Turbos brings a universal notion of digital asset ownership and unprecedent horizontal scalability to decentralized finance (DeFi).

Turbos’ mission is to make DeFi accessible to the next billion Web3 users and to serve as a pivot between Sui ecosystem projects and the market.

They revolutionize decentralized trading by popularizing the concept of concentrated liquidity. The platform achieves a higher degree of capital efficiency by reducing the trading range in which liquidity is provided, effectively eliminating unused collateral and maximizing the potential for returns.

Turbos Usecases

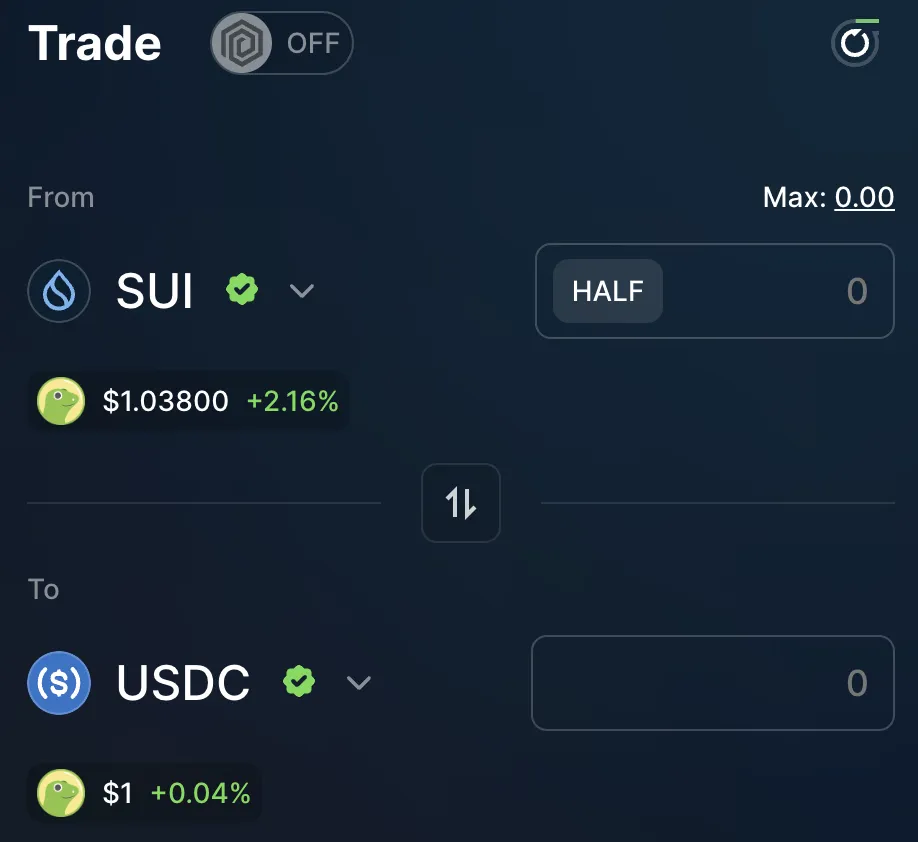

Trading

Turbo offers very fast and reliable trading on SUI.

Simply connect your Wallet (SUI Wallet, Martian, OKX, …) and choose the Token you want to swap.

You can swap between every Token on the SUI Blockchain.

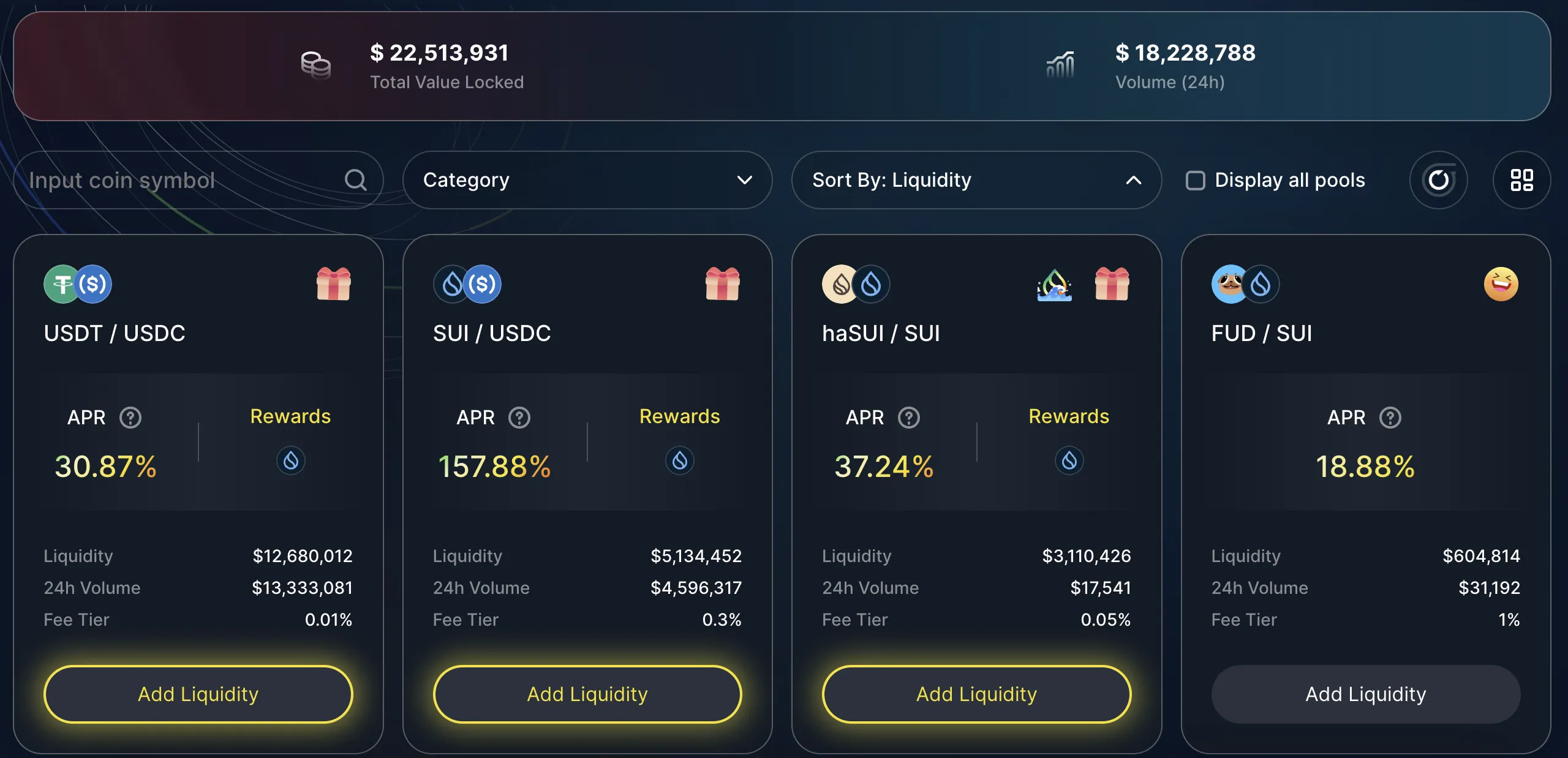

Gain Fees and Rewards by Providing Liquidity.

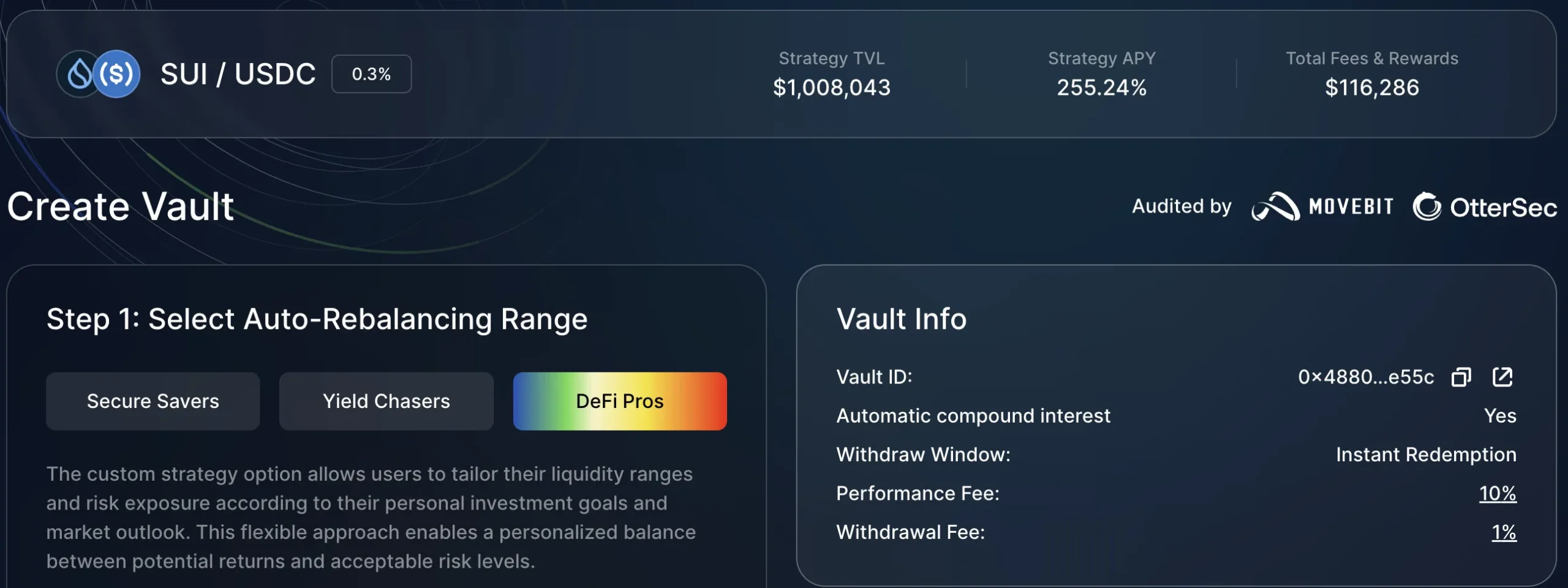

Turbos CLMM DEX allows users to provide liquidity at specific price ranges to maximize capital efficiency and reduce impermanent loss for liquidity providers, ensuring a sustainable and profitable trading experience.

They tailor their CLMM Automated Rebalance Vaults to the dynamic DeFi markets, constantly adjusting liquidity ranges and auto-compounding rewards to optimize user investments.

The unique isolated vault design, powered by Sui’s object model and gas economy, enhances security and allows users to customize their rebalancing strategies.

Unlike traditional models that limit strategy options, Turbos’ flexible design empowers users to apply their own strategies and adjust liquidity range based on real-time market conditions and personal risk tolerance.

Turbos Statistics

TVL: $24,633,424

Volume (daily): $3,626,024

Cumulative Volume: $1,782,761,008

Total Accounts: 292,903

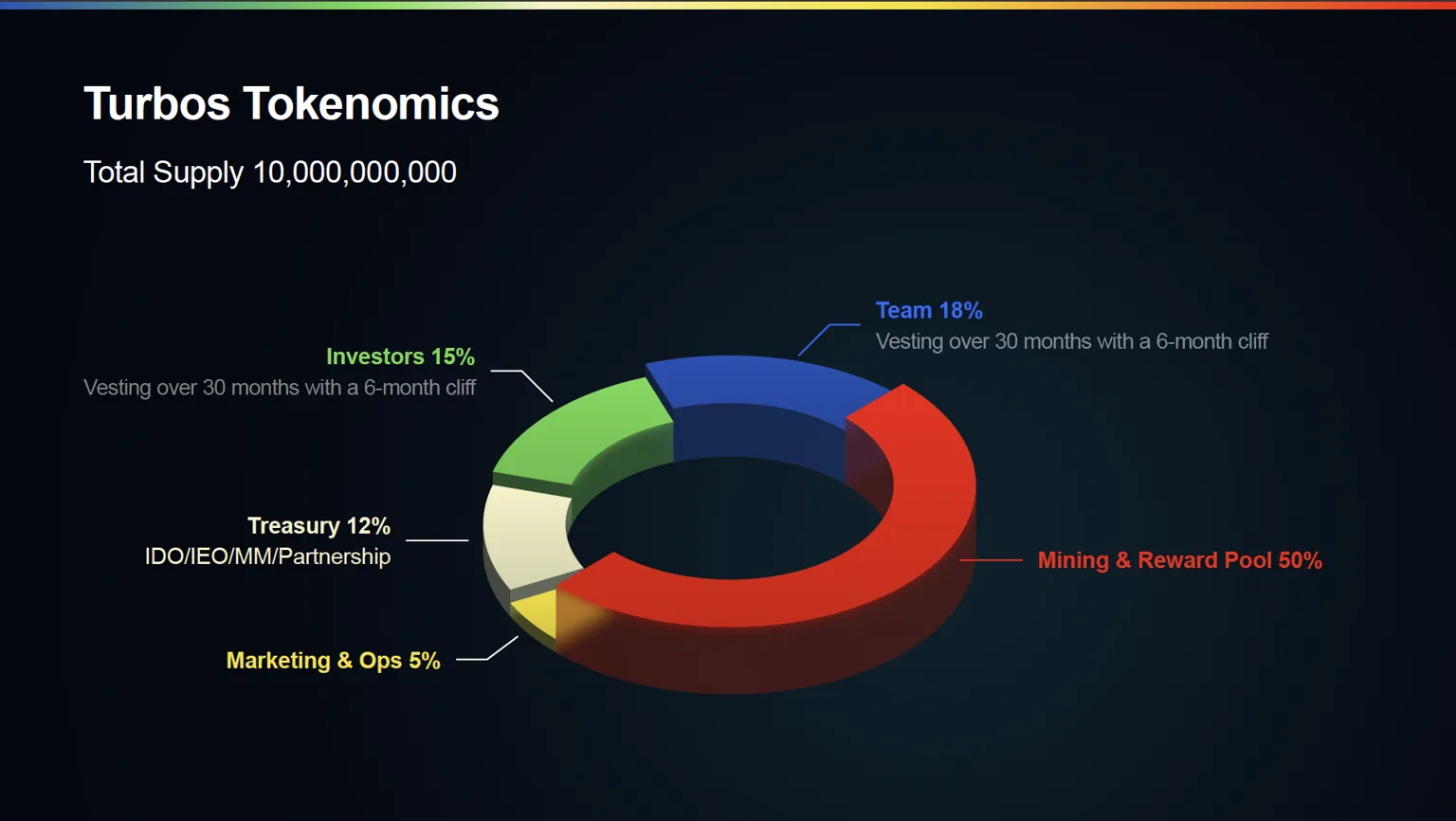

TURBOS, the protocol token on Turbos Finance, is underpinned by a strong token infrastructure designed to provide incentives, rewards, and various utilities for community members, fostering a thriving.

The maximum supply of TURBOS is 10,000,000,000.

Token allocation:

Team: 18%

Private Investors: 15%

Treasury (IDO,IEO, partnership): 12%

Marketing and operation: 5%

All team and investors tokens will be subject to a 3-year vesting schedule with a 6-month cliff.

$TURBOS Utility

Playing a crucial role in Turbos Finance’s ecosystem, TURBOS tokens serve multiple functions that promote a healthy and thriving ecosystem. The TURBOS token has been designed with several key use cases in mind to enhance the functionality of our DEX:

Governance: TURBOS tokens facilitate on-chain governance, empowering token holders to propose and vote on modifications to the DEX’s rules and policies, ensuring the platform remains adaptable and community-driven.

Voting: TURBOS tokens enable holders to participate in votes on specific proposals or decisions pertaining to the DEX, such as the introduction of new trading pairs or referral of projects to CEX partners, fostering a collaborative decision-making process.

Staking: TURBOS tokens can be staked to supply liquidity to the platform, allowing users to earn a portion of trading fees as a reward. This mechanism incentivizes users to contribute to the liquidity pool, fostering a liquid and efficient trading environment.

Trading fee rebates: TURBOS tokens can be employed to provide discounts or rebates on trading fees for users holding a predetermined amount of tokens, stimulating token usage, demand, and potential value appreciation.

The TURBOS token serves a multitude of purposes within the DEX ecosystem, including governance, voting, staking, and trading fee rebates. These incentives help attract liquidity, bolstering a robust and thriving environment for decentralized trading on Turbos Finance.

Turbos Fee Tiers

Understanding fee tiers is essential for liquidity providers and traders within the Turbos ecosystem. Turbos uses a tiered fee structure based on the correlation and stability of the token pairs. This guide provides an overview of the three fee tiers available in Turbos and the criteria for each.

Volatile Pairs: 1%

Volatile pairs are token combinations that are subject to significant price fluctuations. To compensate liquidity providers for the higher risks associated with these pairs, a fee rate of 1% is applied. This ensures that liquidity providers are fairly rewarded for offering liquidity to more unpredictable token pairs.

Most Pairs (Higher Correlation): 0.3%

Most pairs with a higher degree of correlation, such as some stablecoin combinations, will incur a 0.3% fee. These pairs generally exhibit less price volatility compared to the more volatile pairs, but they aren’t entirely immune to price fluctuations. This fee tier offers a balanced rate for liquidity providers to ensure reasonable compensation for their provided liquidity.

Pegged Pairs (Stable): 0.05%

For token pairs that typically trade at a very tight range or are pegged to a specific value, a fee of 0.05% is applied. These pairs are generally the least volatile, with minimal price risks. Liquidity providers of these pairs can expect minimal fees due to the stability of these assets.

Conclusion

Turbos Finance’s Socials

Website: turbos.finance

App: app.turbos.finance

Twitter: x.com/Turbos_finance

Discord: discord.com/invite/fp9ySpbw9S

Telegram: t.me/TurbosFinance

Docs: turbos.gitbook.io/turbos

Disclaimer

No Financial Advice. Please always do your own research. We are not responsible for any losses.

All links on this Website may be referrallinks.

Back to the Homepage: https://explore-crypto.com

Related Posts