Scallop – Lending & Borrowing on SUI

Scallop is a rapidly growing App on the SUI Blockchain. The Core Usecase is their Lending & Borrowing with many incentives, a fast and easy to use Dashboard & many more.

What is Scallop?

Scallop is the next generation money market based on Sui. They are setting new standards with institutional-grade quality, seamless composability, and robust security. With a TVL (total value locked) of over $130M and a Total Supply of over $200M the project is placed as Number 3 in the “highest TVL ranking” for the SUI Blockchain.

Why Scallop?

Scallop features an industry leading model with features like:

– Trilinear Interest Rate Model

– Protected Collateral Vault

– Soft Liquidation

– Delayed Model Change

– Borrow/Outflow/Collateralization Limits

& many more.

Highest Security

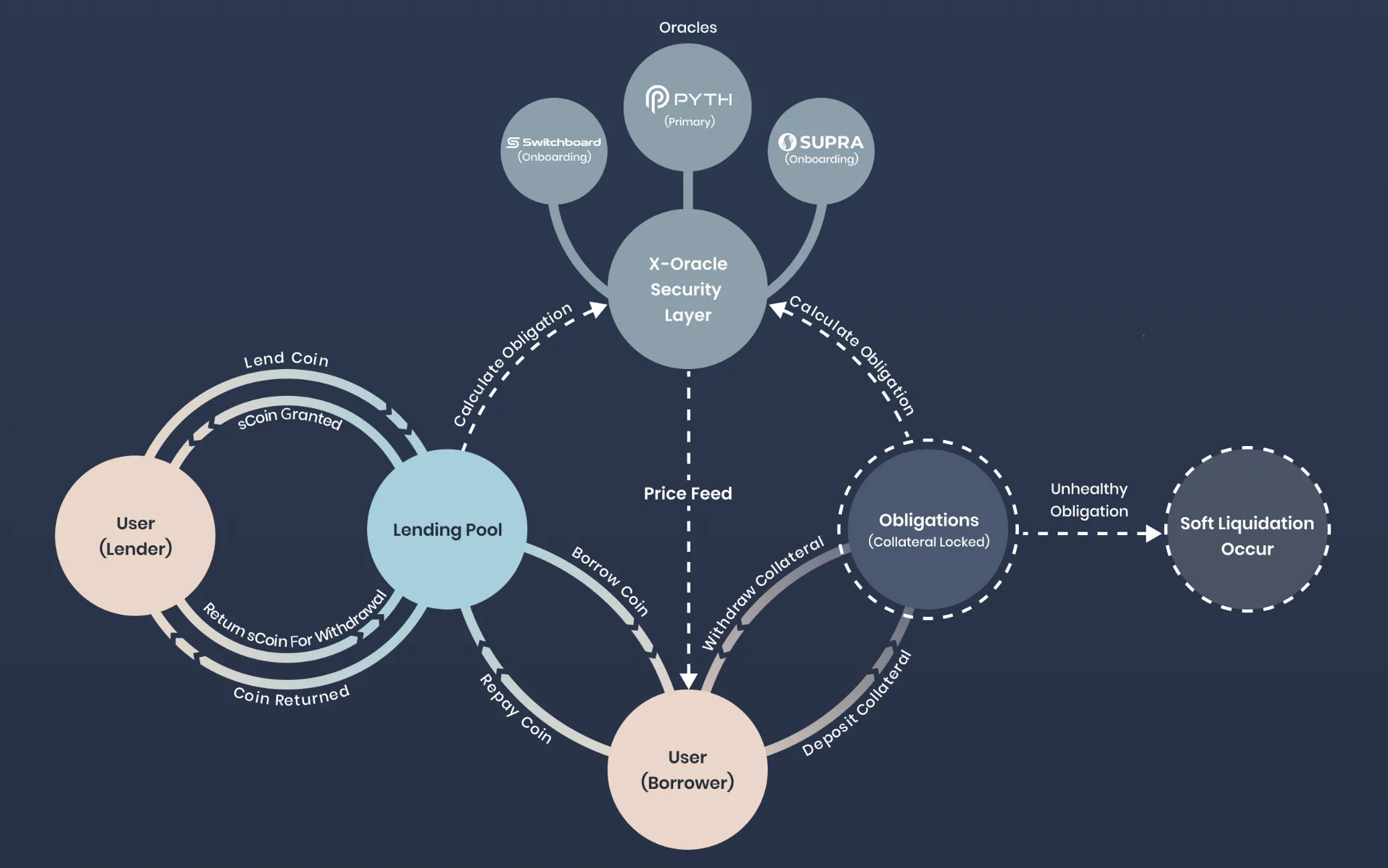

Scallop benefits from a team with huge knowledge. They have a team with cybersecurity & CTF challenge background which wants to make their dApp as safe as possible, so they implemented:

– Security Partners – Zellic, Ottersec & MoveBit

– Multi-Oracle Strategy

– Open-source Protocol

– Bug Bounty

How Scallop Lend Works?

Scallop’s Investors

$SCA (Scallops Token)

Scallop has a own token called $SCA. The Token has a max supply of 250,000,000 SCA. Also, this is the Token Allocation:

Liquidity Mining

45% Distributed via a variety of liquidity incentivization schemes.

Scallop Project Contributors

15% Owned by the founding team contributors.

Dev & Operation

4% Allocated for development and operational purposes.

Strategic Partners/Investor

15% Up to 15% reserved for private fundraising and strategic partnerships.

Advisor

1.5% Owned by key advisors.

Ecosystem/Community/Marketing

7.5% Allocated to fund marketing and platform growth initiatives.

Liquidity

5% reserved for liquidity.

Treasury

7% reserved for the Treasury.

Scallop App

As swaps, bridges and referrals are very easy to understand, we will only cover lending and borrowing.

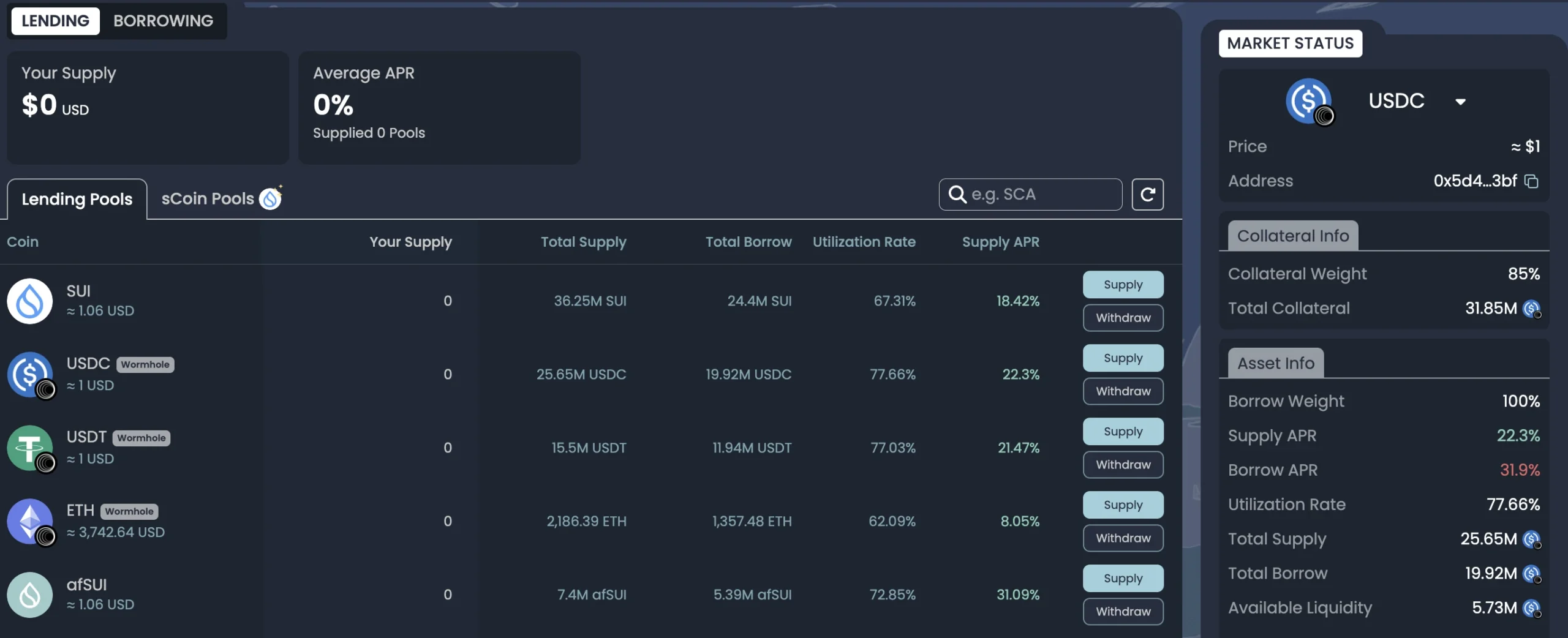

Lending

The Supply APR’s mostly change between 15-30% which is very good for stablecoins like USDC. They are auto compounding, so you don’t need to harvest, your supplied amount will simply grow over time.

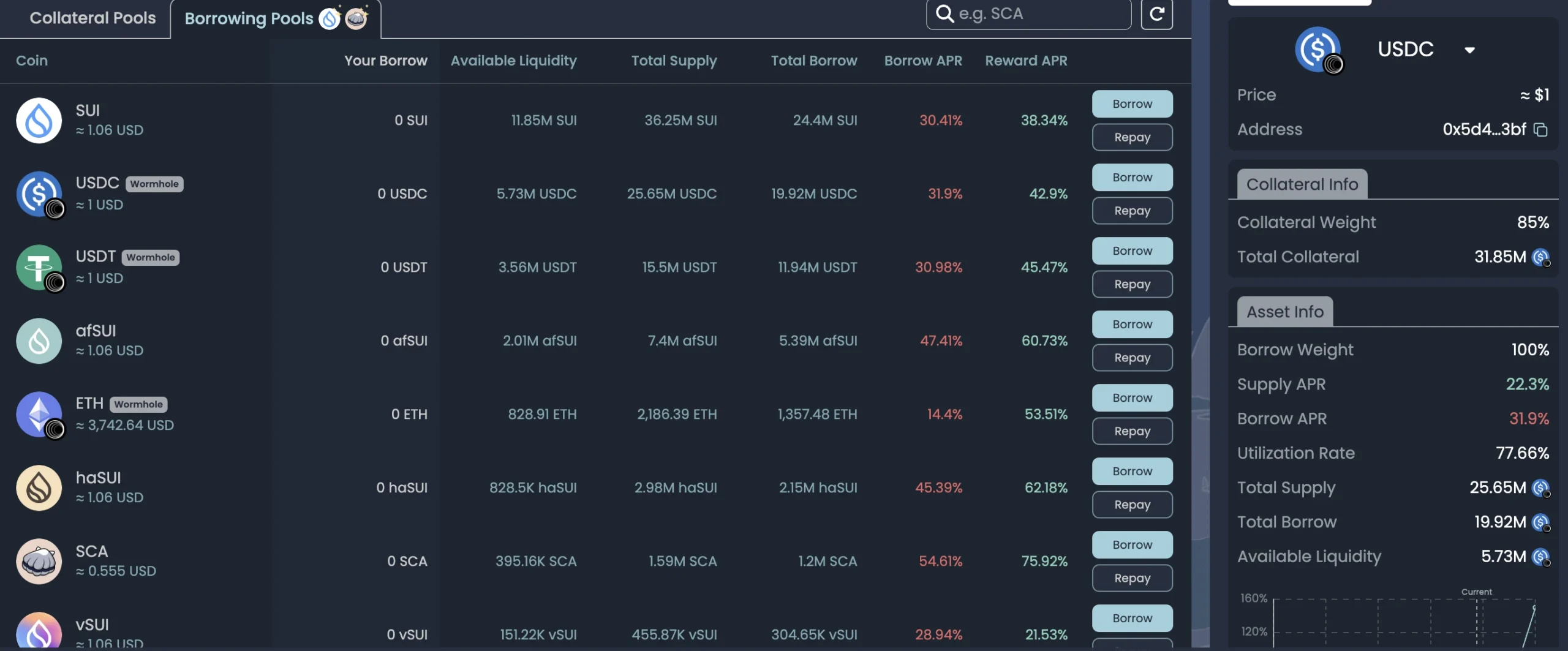

Borrowing

Depending on your risk management, you could repeat this process by swapping your borrowed tokens into another token which you then deposit again in the collateral pool. But keep in mind that there is a higher risk attached to this.

Conclusion

We love their design, their community, their features and the team.

Congrats on this awesome project!

Scallop’s Socials

Website: www.scallop.io

Twitter: x.com/Scallop_io

Discord: discord.gg/F7umecFArJ

Telegram: t.me/scallop_io

Docs: docs.scallop.io

Disclaimer

No Financial Advice. Please always do your own research. We are not responsible for any losses.

All links on this Website may be referrallinks.

Back to the Homepage: https://explore-crypto.com

Related Posts