What is Navi?

NAVI is the first Native One-Stop Liquidity Protocol on Sui. It enables users to participate as liquidity providers or borrowers within the Sui Ecosystem.

Liquidity providers supply assets to the market, earning passive income through yields, while borrowers have the flexibility to obtain loans for different assets. With its focus on providing essential DeFi infrastructure, Navi aims to be a key player in the rapidly evolving world of DeFi in the Sui Ecosystem

Why Navi?

Navi’s offering includes a decentralized liquidity protocol. It allows users to lend and borrow cryptocurrency assets without intermediaries, using a shared liquidity pool system.

Navi’s liquidity pools are created for each supported asset, and users can deposit their assets into these pools. They receive Navi receipt tokens in return, which represent their share of the pool (i.e. nSUI). These tokens can be used as collateral to borrow other assets from the pool. The collateralization ratio determines the amount that can be borrowed, and it is adjusted dynamically based on supply and demand.

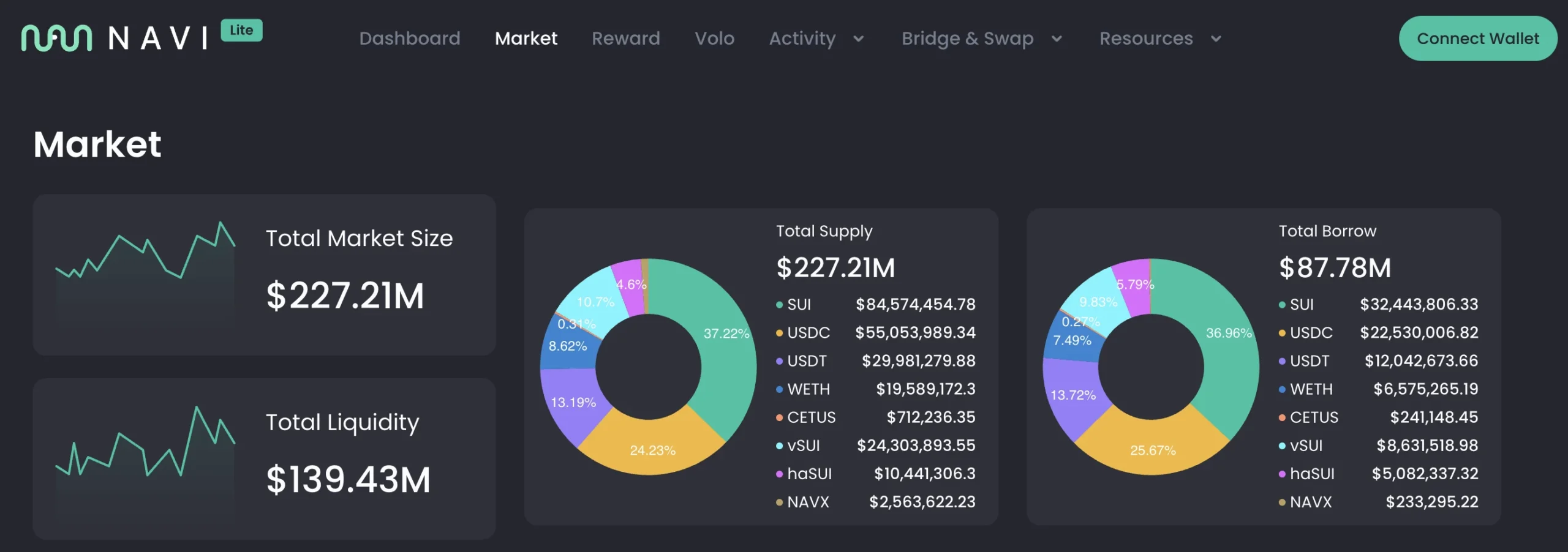

Navi Statistics

TVL: $224,707,283.19

Total Borrowed: $84,875,139.43

User Amount: 825,036

Partners:

Sui Foundation, Supra Oracles, Typus, Notifi, Aftermath, Ethos, Blockvision, YouSUI, Pyth & more…

Audits:

OtterSec, Movebit

Investors:

OKX Ventures, dao5, #hashed, Cetus, Maverick, Mechanism Capital, Benqi, Gate.io labs, ViaBTC & more…

$NAVX Token

$NAVX Token is a vital component of the NAVI Protocol ecosystem. Lets dive into $NAVX token’s distribution, emission schedule, utilities, and governance role.

Max Supply: 1,000,000,000 $NAVX

The $NAVX token has a wide range of use cases within NAVI Protocol. These use cases for $NAVX have been designed to promote growth and asset composability across the broader Sui DeFi ecosystem. They are part of the structured journey toward achieving decentralization, community governance, and vital protocol autonomy.

Governance:

Token holders can participate in the governance of the NAVI Protocol by voting on proposals and updates.

Dynamic Liquidity (dLP) provision:

Users can provide liquidity to NAVX/SUI and NAVX/vSUI pairs in DEXes to get LP tokens. They can then lock their LP tokens for a period of time in proportion to their supply amount to activate eligibility to receive rewards within the money market.

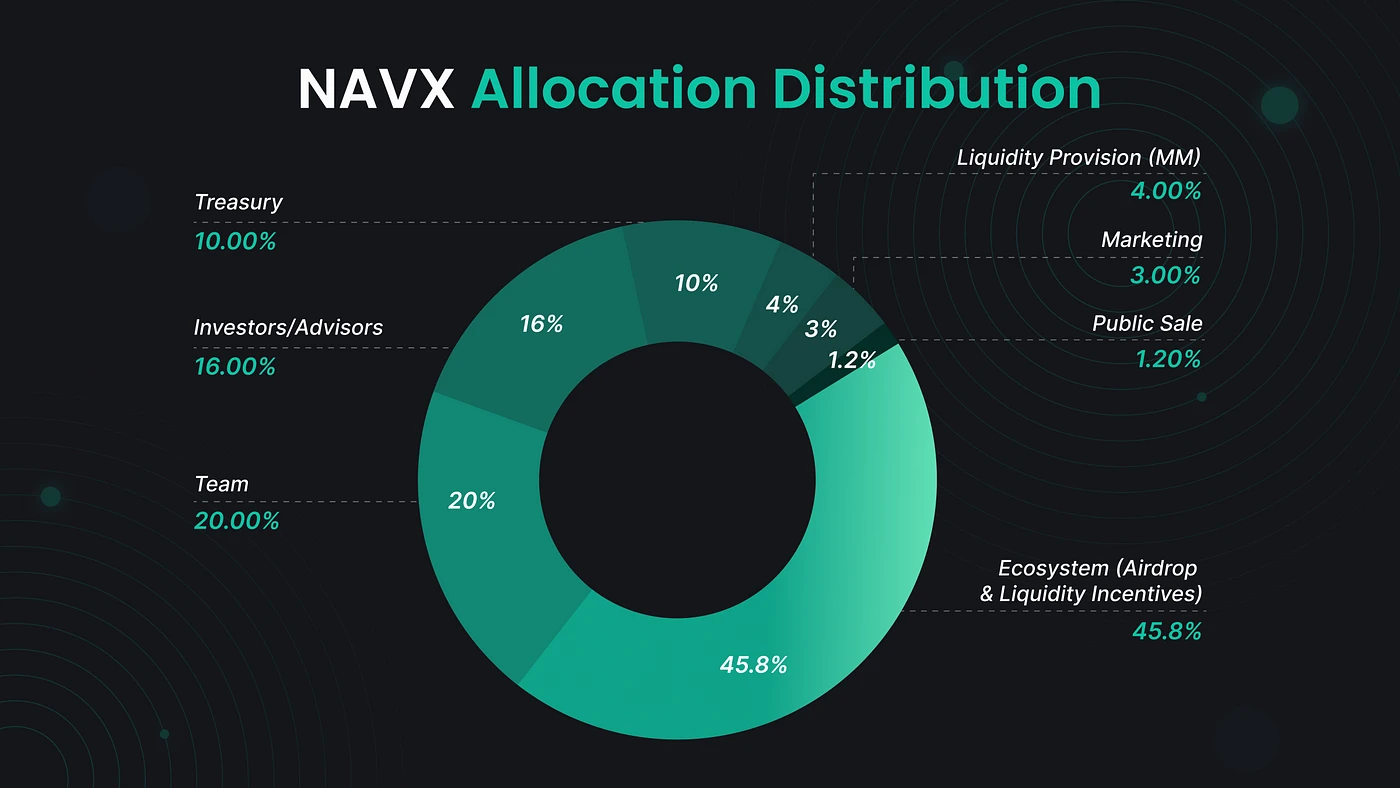

Token distribution

The $NAVX token allocation is designed to support the growth, sustainability, and decentralization of the NAVI Protocol. Here’s how the tokens are distributed:

Token Emission

The $NAVX Tokenomics endeavors to foster a shared vision of harmonization among stakeholders operating within the NAVI ecosystem, protocol functionality, and the $NAVX token, which forms a vital pillar of security for the NAVI Protocol.

Below, you can find the vesting table and release schedule for $NAVX during, and post-IDO:

Risks using Navi

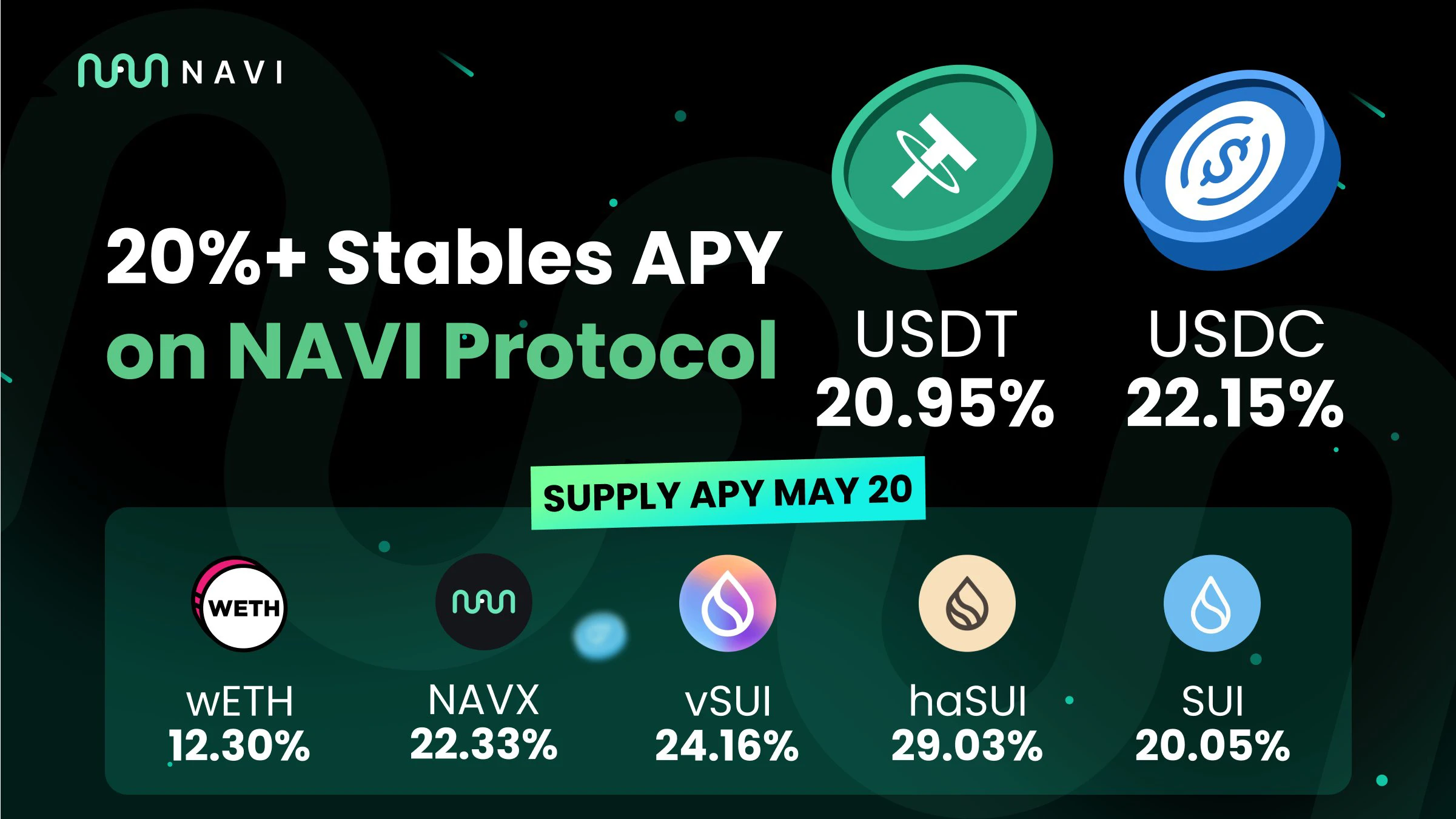

Lending on Navi

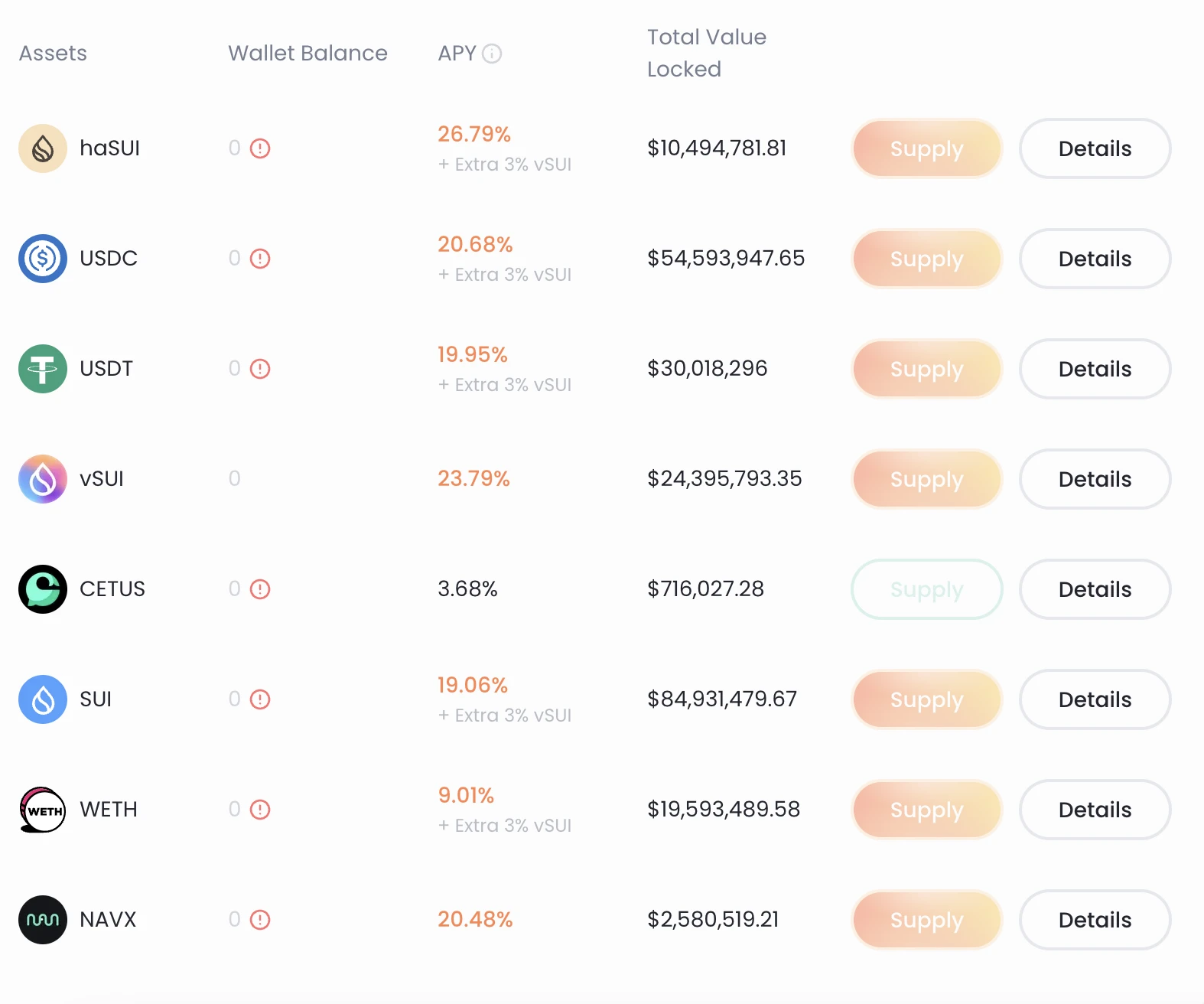

Deposit/Supply

– Go to the dashboard page at app.naviprotocol.io where you can supply assets.

– At the “Assets To Supply” list on the left side, you can view the available lending markets.

– Click the “Supply” button of the asset you own, then select the amount you want to supply and click on the “supply …” button.

– Check the APY, Gas Fee, and Health Factor, then click on confirm to supply.

– Once the transaction is confirmed, your supply is successfully registered and you will instantly begin to earn interest.

Is there a minimum or maximum amount to supply?

You can supply any amount you want, there is no minimum or maximum limit. However, it’s important to take into account that for small deposits, it is possible that the transaction cost of the process is higher than the expected earnings. It is recommended that you consider this when depositing a small amount.

How do I withdraw?

Go to the “Dashboard” section and click on “Withdraw”. Select the amount to withdraw and submit the transaction. Be careful, withdrawals may reduce your health factor and increase the risk of liquidation.

Borrowing on Navi

The key feature NAVI offers is overcollateralized lending/borrowing. This means you can supply an asset as collateral and borrow out another type of asset.

Before borrowing, you need to make sure you have deposited assets as collateral. The maximum amount that users are eligible to borrow depends on the value of deposits, asset type, and the assets available liquidity.

– Once depositing your assets as collateral, select the assets to borrow from the dashboard page.

– Click on “Borrow” at the bottom of the panel, and input the amount to borrow using number input, max, or the slider

– Click on ”Confirm” and approve the transaction on the pop-up wallet.

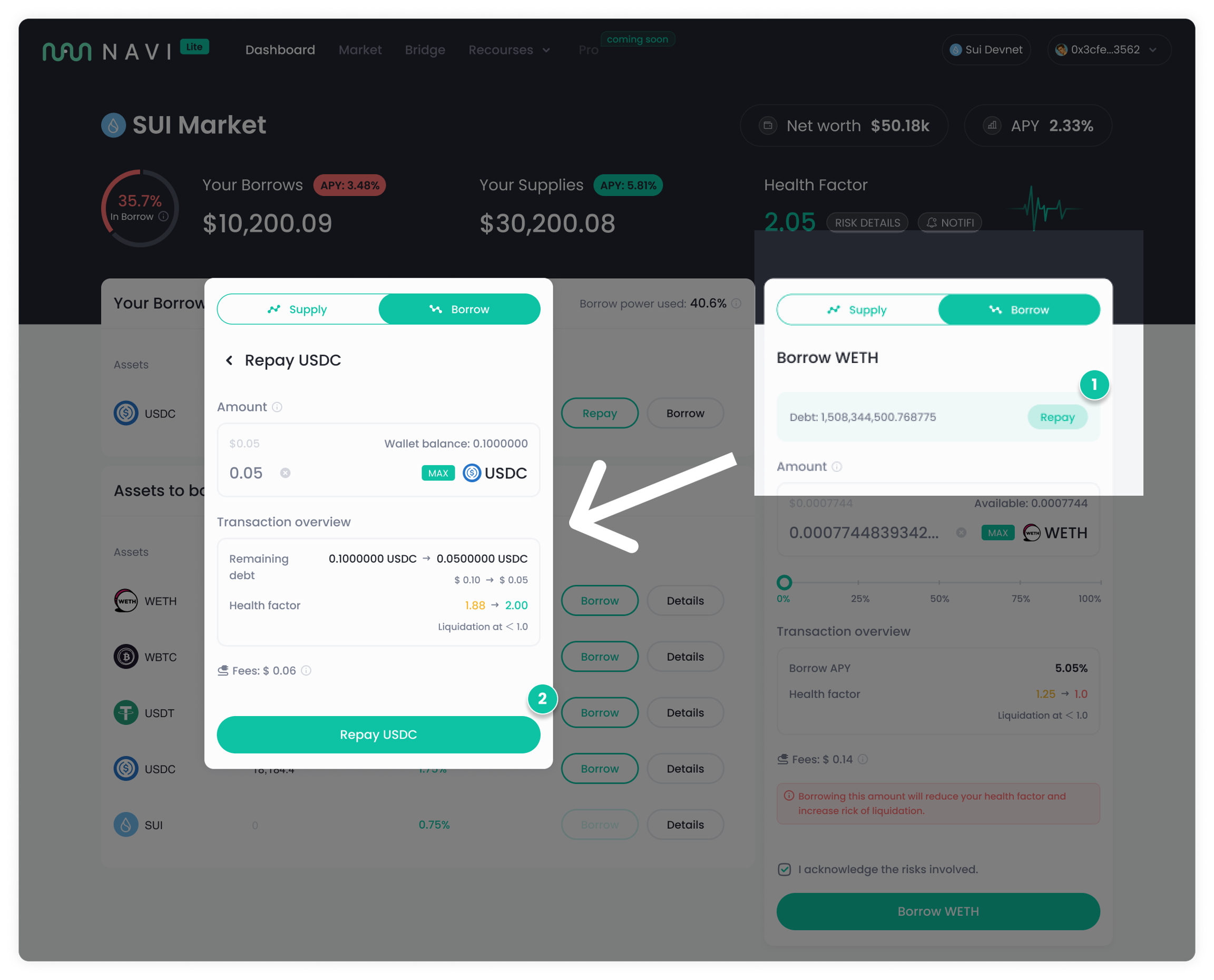

How do I repay my loan?

You repay the loan in the original format of the asset one borrowed. For example, if you borrow 1 Sui initially, you need to pay back 1 Sui + interest accrued(in Sui). You can only repay with your wallet balance, not collateral.

If you have debts, the debt amount and “Repay” button will appear at the top of the operation area. Click the Repay button to the next step.

– Enter the amount to repay, the tokens will be deducted from your wallet balance.

– Click on the “Confirm” button and approve the transaction in Sui compatible wallet

– Once the transaction succeeded, the loan is repaid at the input amount.

Conclusion

Navi’s Socials

Website: naviprotocol.io

App: app.naviprotocol.io

Twitter: x.com/navi_protocol

Discord: discord.com/invite/R6Xkbee8Xq

Telegram: https://t.me/navi_protocol

Docs: naviprotocol.gitbook.io

Disclaimer

No Financial Advice. Please always do your own research. We are not responsible for any losses.

All links on this Website may be referrallinks.

Back to the Homepage: https://explore-crypto.com

Related Posts